Mobile payment solutions like Google Pay have multiple benefits to consumers and businesses, but small towns are behind in adding it to their businesses.

Google has been providing a digital wallet option since 2011 with Google Wallet, and since that time the service has gone through multiple phases of evolution to what we now know as Google Pay. Google Pay has become a much more well-known product, usable in millions of stores, thanks to the proliferation of NFC adoption and, in no small part, to Apple Pay. But even with all of that growth, access to contactless payments in smaller communities is still scarce.

Living in rural Kansas, my experience when going to local retailers, restaurants, and gas stations is to expect no access to Google Pay. That's not to say that I don't come across it from time to time; instead, it's rare enough of an encounter that I have been trained to not even look for it as an option.

The "big town" near my home is about 15,000 people at best, but many of the stores either don't offer contactless payment or advertise it as an option.

In the past few years, I have seen an uptick in the places in my area that offer it, but that is still primarily businesses that are part of a larger chain. Even still, many of those don't have any signage up that would indicate that the point of sale (POS) terminals are NFC-ready. So, when it comes time to pay, I've already got my card out and ready to swipe, even though my TicWatch E3 is prepared and supports Google Pay.

When I venture to the smaller towns nearby, population 1000 and under, contactless payments are virtually non-existent. When I talked with one of the gas station owners in one of these towns, he said he'd heard of Apple Pay and maybe Google Pay. When asked if he planned to update his POS terminal to accept these types of payment options, he said, "Maybe, if I have to. But, what I have works, and it's not worth my hassle to change the equipment out."

It's up to Google and Apple to find ways of educating small businesses in all communities to the benefits of accepting mobile payments.

Traditionally, smaller communities are comprised of an older population or more traditionally rooted people. From their way of life to how payments are handled in the various businesses, using their phone to pay for goods and services is not the first thing they think of. However, with technology permeating deeper into these communities through the younger generations and how they're exposed to payment apps like Google Pay and the benefits it provides, these merchants will see increased pressure to adapt.

While all payments at physical retailers saw a drop during the peak of the pandemic in 2020, payments made via mobile services like Google Pay, Samsung Pay, and Apple Pay saw considerable increases in registration worldwide. According to the UK Payment Markets Summary 2021 from UK Finance, the number of 17.3 million adults registered for mobile payments in 2020 — an increase of 7.4 million in 2019. Moreso, of those, 84% of them had registered at least one payment.

While it doesn't designate how many of those purchases were online versus through a mobile device, the top Android phones or Google Pay enabled smartwatch, the interest in mobile payment options is there.

When looking at the United States specifically, a Verisk Financial Research report found that "adoption of mobile payments in the United States is making progress, albeit at a slower rate than in other developed markets, even though around 83 percent of Americans owned a smartphone at the end of 2020 (up from around 69 percent in 2015)."

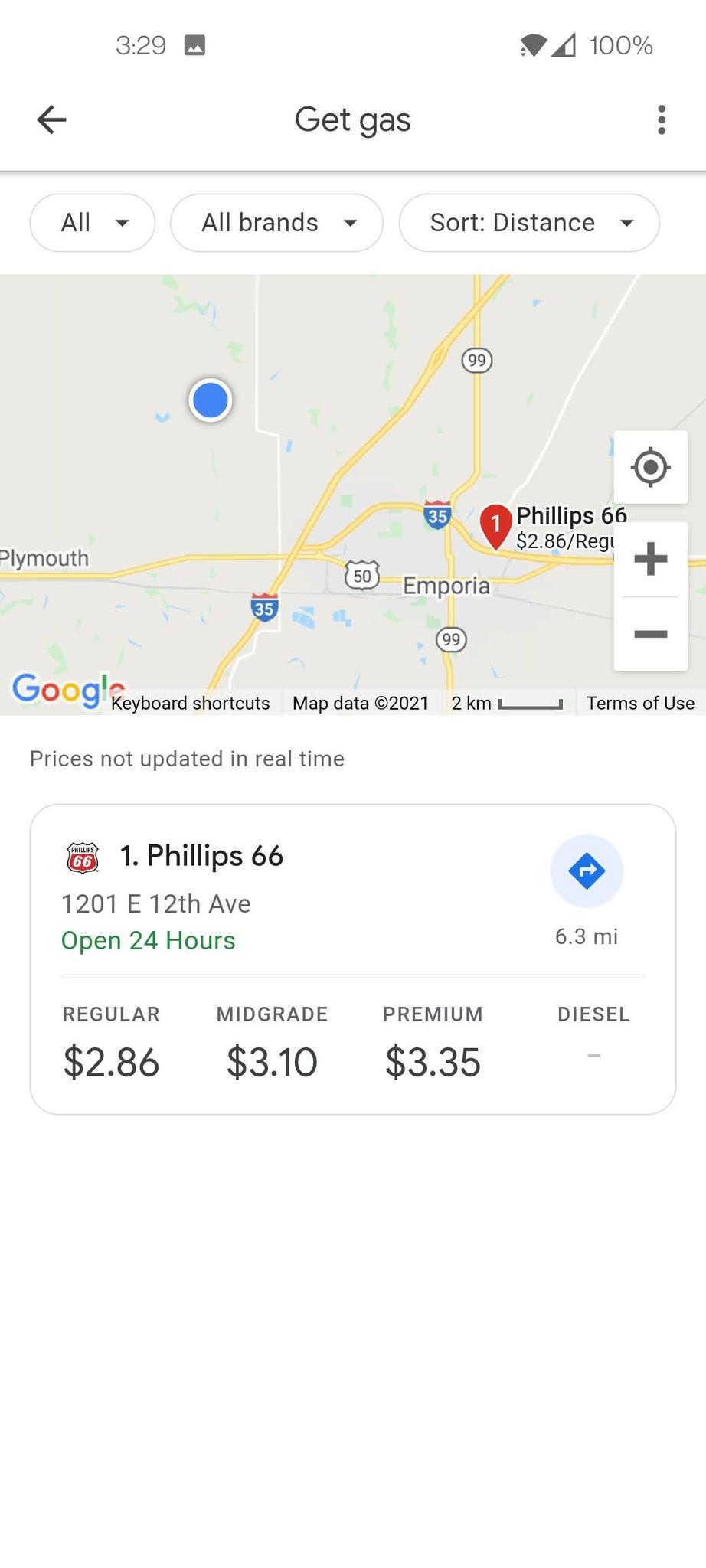

On my road trip earlier this summer, I was very glad to find that nearly all of the gas stations I stopped at along the trip offered contactless payment directly at the pump. This let me simply use my watch to pay and helped keep all of my receipts in order in the Google Pay app — not to mention avoiding any potential credit card skimmers.

It's clear that larger cities, especially those with a younger or more tech-forward population, are more apt to accept a less traditional payment method. The UK Payment Markets Summary 2021 bears that out, where 89% of people who made contactless payments in 2019 were in the 34-44 age group. The lowest rate of usage was in the 65 and older age group.

When I visit locally owned businesses with younger entrepreneurs, I have found that many of these businesses offer a payment option that can accept contactless payments. Interestingly, a lot of the time, the owner has opted to use a payment terminal from Square rather than one of the leading suppliers in North America like Verifone, Ingenico, or Pax.

According to a Verisk Financial Research report, "the United States has a highly developed and competitive retail banking and payments market. However, emerging payment technologies are only now displacing comparatively old-fashioned POS systems." While small business owners in more rural communities are willing to stick with the older, non-NFC-enabled payment terminals they currently have because it still works, much of the world shows a preference towards newer payment technologies.

Retailers can obtain their POS terminal by either buying it outright, leasing it, or it gets it as part of their agreement with a transaction processing company. The cost to upgrade to a terminal that accepts NFC can range from $0 to $200 depending on the brand and company providing the hardware. For a small-town retailer, it's about more than just plugging in a new machine, it is learning a new system and terminology — and that can be offputting.

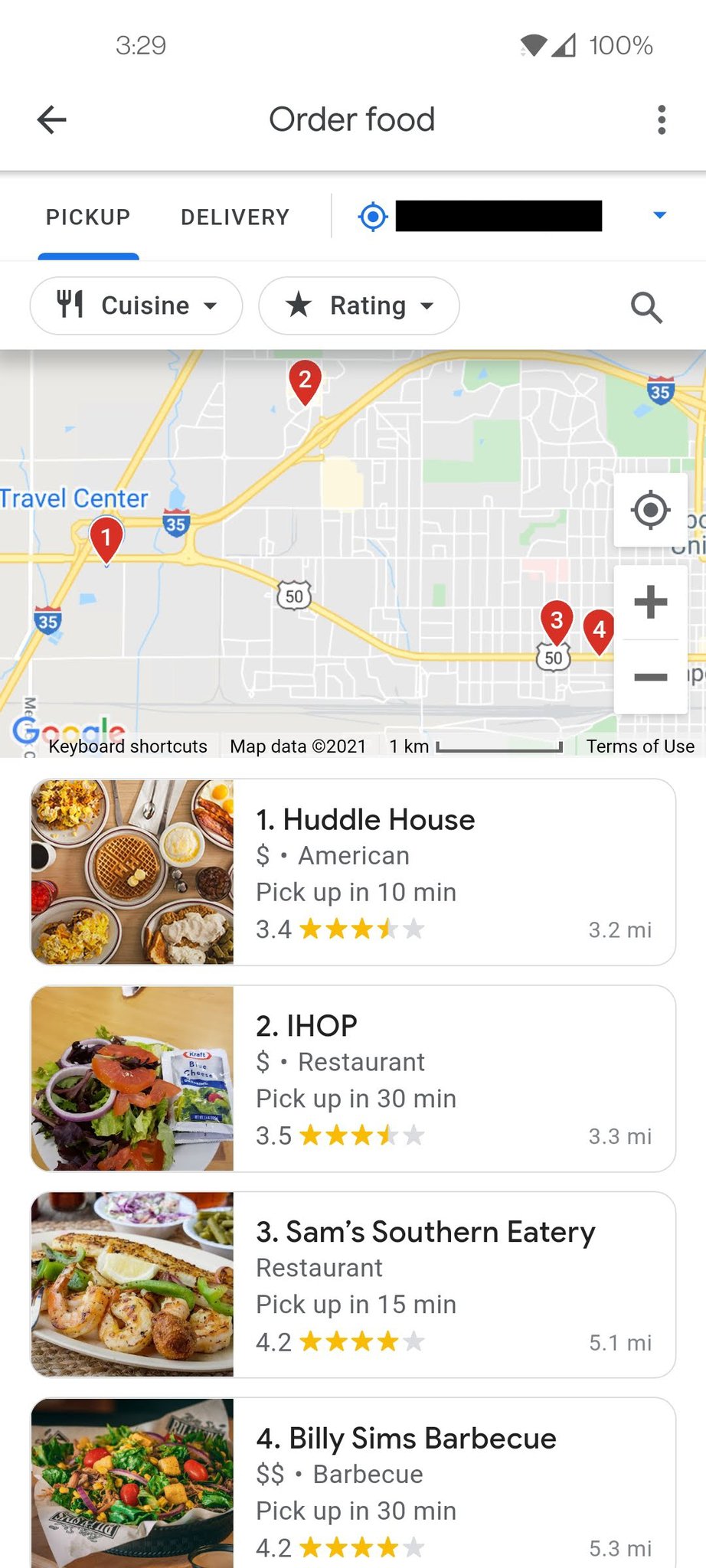

Nothing is stopping me from swiping my card at these businesses, however, it does restrict the benefits that I can use with mobile payment services like Google Pay. Many of these services offer discount or reward programs when using them at retailers in addition to online. When you open the Google Pay app on your phone, it can show you businesses nearby that you can use the service at — for me, that's a very limited list.

Being unable to use a contactless payment opinion is unlikely to cause me to choose one local business over another — at least in the short term. As risks from making payments by swiping a card through the terminal increase — card skimmers and data breaches — using a payment option like Google Pay becomes more attractive thanks to single-use transaction tokens.

I just hope that the means by which businesses in smaller communities get easier and the incentives to them become more apparent. Because while mobile payments and contactless payments aren't perfect, the choice to use these options can benefit everyone — not just those in the big city.

Post a Comment